With PayPal stock down 80%, finance chief Jamie Miller steps in as interim CEO

PayPal turns to HP’s Enrique Lores as the next chief executive.

Good morning. Turnover continues in the Fortune 500, with PayPal offering the latest example of boards turning to finance leadership during periods while under pressure.

The payments giant announced on Tuesday that CEO Alex Chriss is stepping down after two and a half years. Enrique Lores, CEO of HP Inc., is set to take over on March 1. PayPal’s chief financial and operating officer, Jamie Miller, will serve as interim CEO.

The move follows continued shareholder frustration. PayPal’s stock is down roughly 80% from five years ago, and the company on Tuesday projected lower earnings for 2026, Fortune reported. In announcing the change, the board cited the pace of execution falling short of expectations—language that often precedes leadership resets focused on operational discipline and capital performance.

Miller’s appointment reflects a broader governance trend. According to Crist Kolder Associates’ 2025 Volatility Report, CFO-to-CEO promotions among Fortune 500 and S&P 500 companies reached a decade high of 10.26% last year, up from 6.15% in 2015. All such promotions were internal, underscoring boards’ growing preference for leaders with deep institutional knowledge and financial credibility.

At PayPal, Miller’s remit had already expanded in 2025 to include the chief operating officer role, a combination increasingly used to test CFOs for broader enterprise leadership. Appointed CFO in 2023, she previously served as global CFO of EY and CFO of Cargill, and spent more than a decade at General Electric, including as CFO and CEO of GE Transportation.

Lores, who has led HP for more than six years and served on PayPal’s board since 2021, has experience driving complex transformations and disciplined execution, David W. Dorman, the newly appointed independent board chair at PayPal, said in a statement.

For CFOs watching, PayPal’s transition is another reminder that in periods of volatility, boards are often looking first to financial leadership, whether on an interim or permanent basis, to steady the enterprise and reset performance expectations.

Sheryl Estrada

[email protected]

Leaderboard

Sundip “Sonu” Singh Johl was appointed EVP, CFO, and treasurer of Ring Energy, Inc. (NYSE American: REI), effective Feb. 27. Johl brings more than 20 years of experience. From 2020 through January 2026, he was managing director, co-head of energy investment banking at Raymond James & Associates, Inc. Before that, he was managing director, co-head of E&P at UBS Investment Banking Global Energy Group.

Karen Chan Chi Yin was promoted to CFO of Deswell Industries, Inc. (Nasdaq: DSWL), effective Feb. 2. Chan succeeds Herman Wong, who has resigned from the position to pursue other interests. Chan brings over 20 years of financial experience. She first joined Deswell in 2004, serving as finance and administration manager for a key subsidiary for four years. Chan subsequently built her expertise in senior financial roles at other Hong Kong-listed companies, most recently holding the position of CFO at SIM Technology Group Ltd.

Big Deal

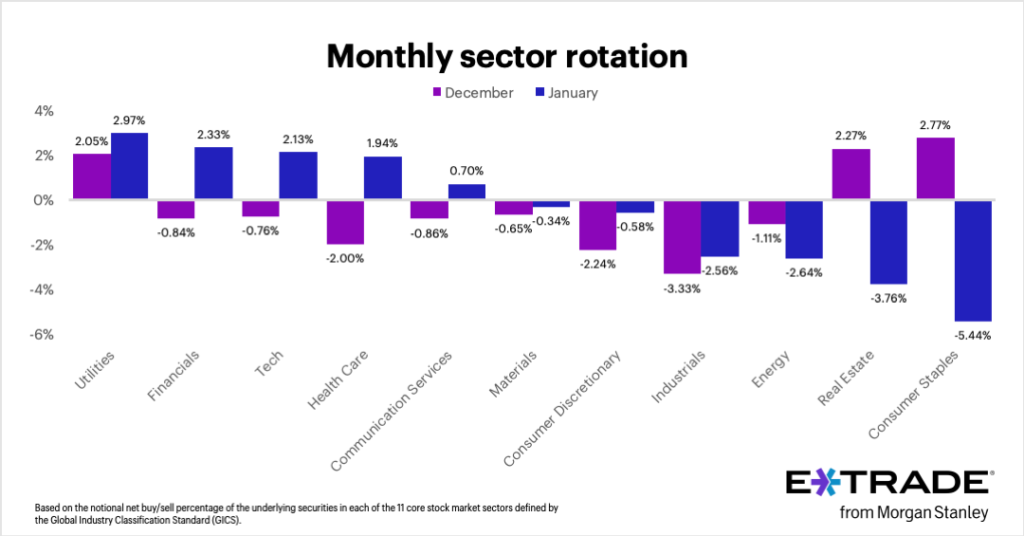

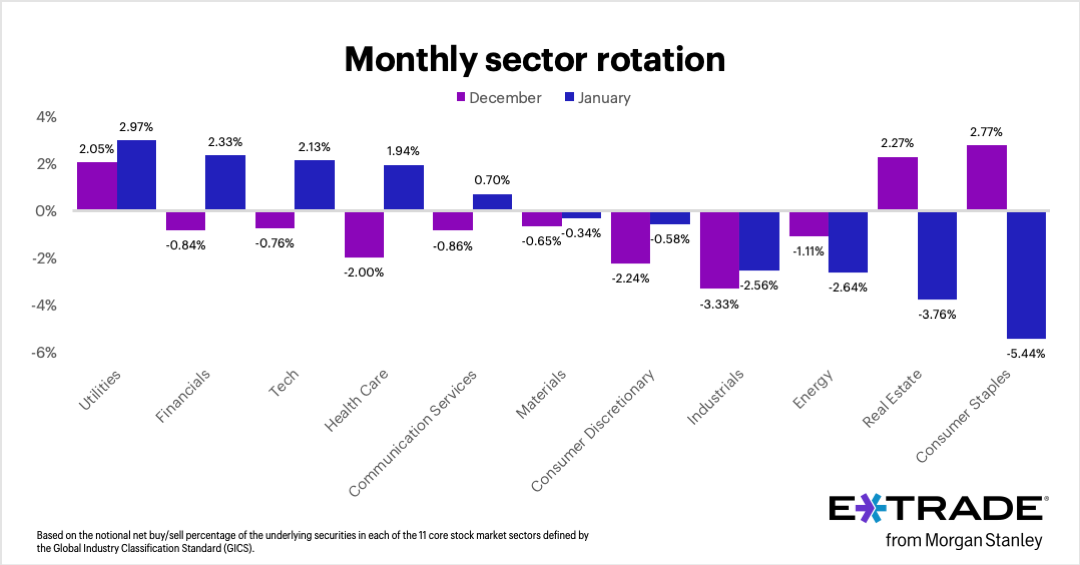

E*TRADE from Morgan Stanley’s monthly analysis finds the three most-bought sectors in January were utilities (+2.97%), financials (+2.33%), and tech (+2.13%). Meanwhile, the sectors with the most net selling were consumer staples (-5.44%), real estate (-3.76%), and energy (-2.64%). The data reflects net buy/sell activity in S&P 500 sectors on the platform.

“As has been the case in recent months, some of the activity in utilities appeared to be less defensive and more ‘risk-on’ buying of alt-energy stocks with ties to the AI datacenter boom,” Chris Larkin, managing director of trading and investing, said in a statement. “Trades in two other areas highlighted a potential contrarian bent last month—clients were net buyers of financials, which was the S&P 500’s weakest sector, and net sellers of energy, which was the strongest.”

Also, trading in the tech sector showed clients were more active in semiconductor stocks than in the market’s megacap AI names, he noted.

Going deeper

It was announced on Tuesday that Josh D’Amaro has been appointed CEO of The Walt Disney Company (No. 46 on the Fortune 500), effective at the upcoming annual meeting on March 18. D’Amaro will succeed longtime Disney CEO Robert A. Iger. A 28-year Disney veteran, D’Amaro is currently chairman of Disney Experiences.

“Disney’s new CEO Josh D’Amaro once planned to be a sculptor. He admits that ‘I don’t know’ is one of the most important phrases in his career” is a Fortune article by Preston Fore.

“D’Amaro has spent nearly three decades climbing the Mickey Mouse corporate ladder, but taking over Main Street USA wasn’t always part of the plan. The 54-year-old has said uncertainty, not a master plan, has guided much of his career,” he writes. You can read more here.

Also, every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

Overheard

“Western multinational corporations must now redesign for a world in which alignment is fluid, currencies are volatile, and allies do not move in lockstep. That requires decisions that many firms have deferred for too long.”

—Ram Charan, an adviser to CEOs and boards, writes in a Fortune opinion piece titled, “What happened at Davos was a warning to CEOs: Their companies are designed for a world that no longer exists.” Charan is the author of the forthcoming book, China’s 90% Model.