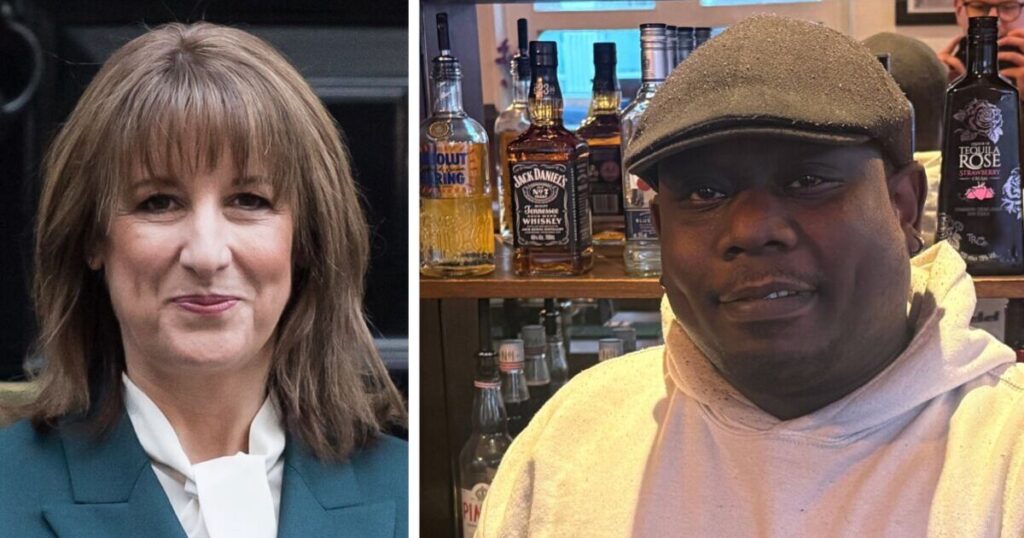

Pub bosses have begged Rachel Reeves to show some humanity as venues are forced to cut staff hours and increase prices. From April 2026, retail, hospitality and leisure relief will be replaced with two lower business rate multipliers for properties with rateable values below £500,000. The lower tax rates will be funded by a higher multiplier applied to all properties with a rateable value of £500,000 or above.

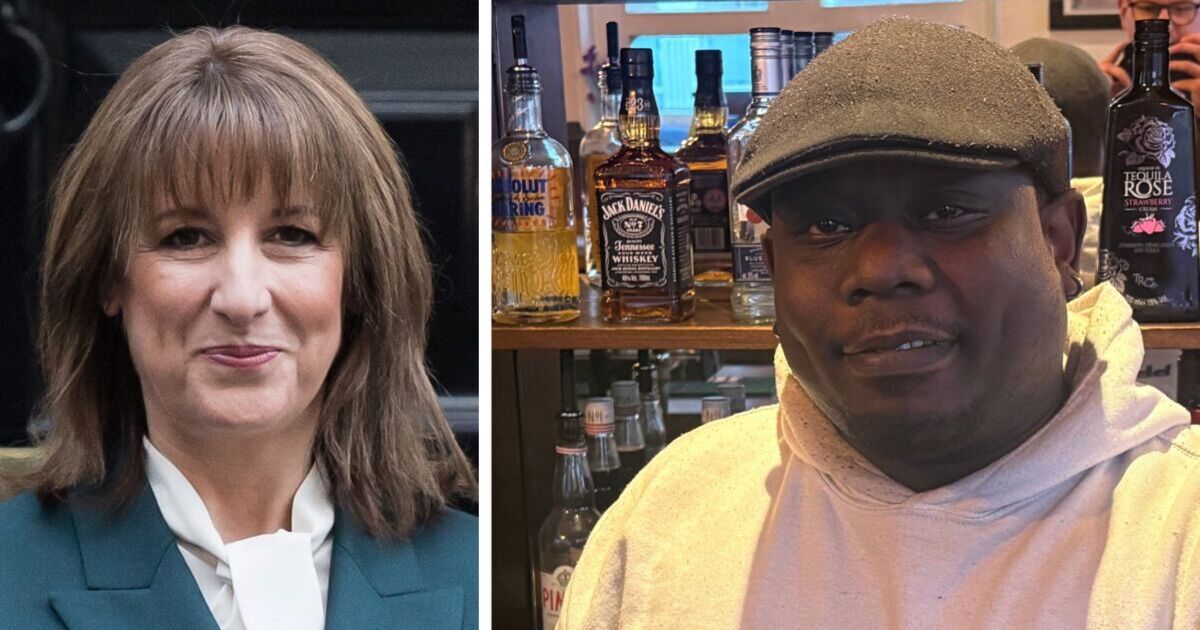

Mike Latim, 40, is general manager of the Jolly Gardeners in Wandsworth. He told The Express: “We’re already struggling as it is, trying to break even. It’s crazy.” He added: “I don’t understand why they can’t freeze it. It’s what’s killing businesses.” Customers are being put off by price increases and more are choosing to buy booze from shops and drink at home instead, Mr Latim said, specifying that he has noticed a 40% to 50% drop in punters, if not more.

He has not increased the price of his pints for three years, but will have no choice but to do so by 10p or 20p in 2026.

“I wish I could make it a 5p increase, but if I did that I wouldn’t be in business anymore,” the Londoner said.

“I’ve had to reduce staff hours staff in general, even opening times. It’s not viable to stay open anymore at lunchtime.

“The whole city’s changing. We’re not really getting younger drinkers, they’d rather go to the off-license and chill in their house.”

In three to five years, punters could be charged £10 for pints, Mr Latim said, as he has seen adding that he could see the price even increasing to £15.

When asked if the Government could be doing more to help, he said: “I can understand the whole [economic] situation, but I do feel they could be doing a lot more.”

But even if that assistance were forthcoming for the sector, the manager thinks the situation is “so bad it’s almost impossible to recover from”.

He added: “We’ll never be back to the same way it was 10 or 20 years ago.

“Nobody really wants to pay for the experiences of going to a pub anymore.”

Nayak Dey, 41, owns the Old Sergeant down the road.

Sitting at one of his venue’s tables, he said he will have to increase his prices next year by about 70p a pint.

Mr Dey said: “Prices go up and we lose customers.

“Instead of people having five pints, they’ll go down to having three pints.”

On whether he felt supported by the Government, the landlord said: “It’s a very tough time. They’re not helping us at all.”

The publican would like to see business rates reduced, or venues like his supplied with small business relief.

In January, Mr Dey said he would have to cut the hours he gives his staff.

“It’s going to be harder, tougher,” he said.

On what he would say to Ms Reeves were she at his bar, he said it “wouldn’t be very nice”.

Mr Dey added: “It’s just there’s no support. It’s common sense, you know. A little bit of humanity would be good.

“It’s really, really tough. It’s not easy going. I’ve been doing this all my life, hospitality anyway.”

He unfortunately knows no different, he said.

The Government announced on Budget day that business rates for permanently lower RHL business rates multipliers, which will benefit over 750,000 RHL properties, including the shops and pubs

The Budget says the Treasury is expanding the Supporting Small Business scheme to businesses that were eligible for the Retail, Hospitality, and Leisure Business Rates Relief scheme, “protecting independent pubs and shops as they transition to permanently lower tax rates”.

This additional support is worth £1.3billion, ministers added.

The Campaign for Real Ale said after Ms Reeves outlined her latest plans: “Pubs and breweries in England are facing big increases in their business rates bills from April 2026 as a result of decisions taken in the Chancellor’s recent Budget, together with a rates revaluation.”