I Asked ChatGPT What Trump’s ‘Big Beautiful Bill’ Means for Retirees’ Taxes: Here’s What It Said

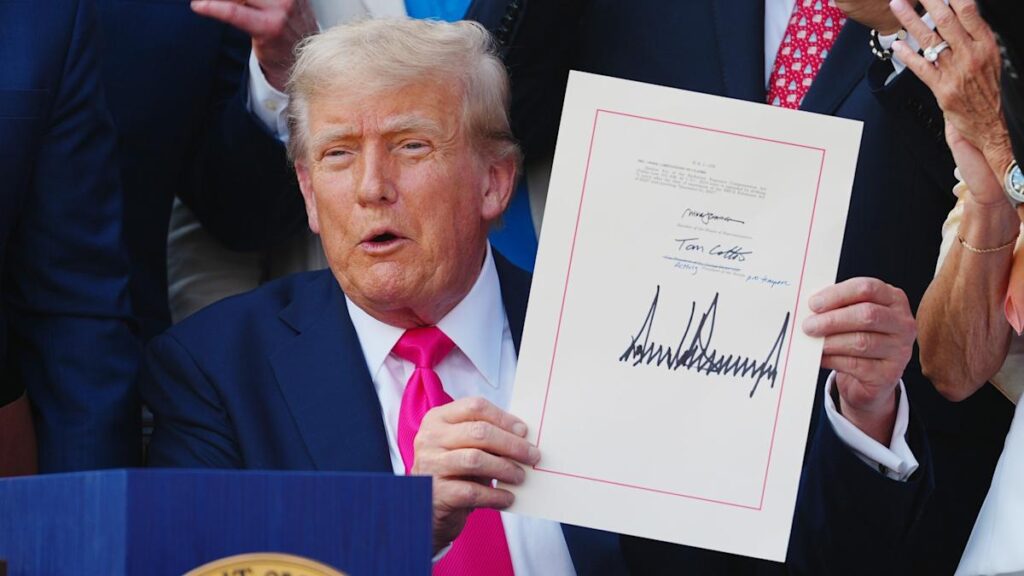

While President Donald Trump’s recently signed “One Big Beautiful Bill” (OBBB) has more provisions than one could ever hope to break down in an article, it’s big on tax changes, including those that will affect retirees.

Read Next: 10 Unreliable SUVs To Stay Away From Buying

Overwhelmed at understanding it, I turned to ChatGPT to learn more about what it means specifically for retirees and their taxes (with fact-checking, of course!).

Here’s what ChatGPT said.

One of the big things that the OBBB does is extend many of the tax breaks originally introduced under the 2017 Tax Cuts and Jobs Act (TCJA). However, it did make some adjustments that retirees need to pay close attention to.

The OBBB maintains the current lower income tax brackets from the TCJA for now, “which means retirees pulling from IRAs, 401(k)s, or other taxable retirement accounts will likely continue to benefit from lower marginal rates through at least 2025,” ChatGPT pointed out.

However, some of those provisions will still end in 2026 unless further legislation is passed. “That means higher taxes on retirement income could be around the corner — especially for those who delay Required Minimum Distributions (RMDs) or Roth conversions,” ChatGPT said.

With current income tax rates remaining lower, it might be a good idea for retirees to consider converting their pretax retirement savings into Roth IRAs, ChatGPT suggested, “locking in today’s lower rate and avoiding potentially higher taxes in future years.”

While the OBBB doesn’t restrict Roth conversions, ChatGPT pointed out that it does underscore how limited a window retirees have to take advantage of current tax policy.

Not only does the OBB uphold the estate tax exemption, which was scheduled to sunset in 2026, but it increases it to $15 million per individual. ChatGPT suggested, “Retirees with larger estates should start working with advisors now to explore gifting strategies, trusts, or other tools while current limits are still in place.”

The OBBB permanently extends the doubled standard deduction, an added benefit to retirees who no longer itemize deductions like mortgage interest or large charitable contributions, ChatGPT informed me.

“This simplifies filing and reduces taxable income for many,” it wrote. Retirees who do still itemize won’t benefit from this change, unfortunately.

Healthcare expenses are always a huge concern for retirees. The OBBB does not eliminate the ability to deduct qualified medical expenses over 7.5% of AGI, which is critical for retirees with significant healthcare costs.

While these all sound like good things for retirees and their taxes, I asked ChatGPT if there were any downsides for retirees within the OBBB?

One downside is that the OBBB doesn’t address the way retirement income can push retirees into higher brackets for Medicare premiums (IRMAA) or taxation of Social Security benefits, ChatGPT wrote. Thus, “Even with lower federal tax brackets, higher income can trigger other hidden costs — and retirees may still be caught off guard,” ChatGPT wrote.

The One Big Beautiful Bill gives retirees short-term certainty with continued low tax rates, but it doesn’t eliminate all of the 2026 sunset risks. “Retirees should consider proactive moves now, like Roth conversions, income acceleration, or estate planning updates, while rates are still favorable,” ChatGPT wrote.

ChatGPT also emphasized the importance of “active planning.” Otherwise, “Retirees could end up with a larger-than-necessary tax bill, or miss out on optimization strategies like bracket management or asset location.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I Asked ChatGPT What Trump’s ‘Big Beautiful Bill’ Means for Retirees’ Taxes: Here’s What It Said